Navigating the Complex Landscape: Beyond the Top 10 Health Insurance Companies Compared – How AI and Automation Empower Informed Choices

Estimated reading time: 7 minutes

- Understanding the limitations of a simple “Top 10 Health Insurance Companies Compared” list.

- The impact of AI and automation on effective health insurance selection.

- Key factors to consider when comparing health insurance providers.

- How n8n workflow automation can streamline benefits management.

- Actionable strategies for HR professionals and business leaders.

Table of Contents

- Beyond the Surface: Why a Simple ‘Top 10 Health Insurance Companies Compared’ List Falls Short

- The AI-Powered Advantage: Transforming Health Insurance Selection

- Practical Takeaways and Actionable Advice for HR Professionals and Business Leaders

- How Our Expertise Empowers Your Health Insurance Decisions

- Ready to Optimize Your Employee Benefits with AI and Automation?

- FAQ

Beyond the Surface: Why a Simple ‘Top 10 Health Insurance Companies Compared’ List Falls Short

For many businesses, the allure of a definitive “Top 10 Health Insurance Companies Compared” list is understandable. It promises clarity in a complex domain. Yet, such lists, while a starting point, rarely provide the granular, context-specific insights necessary for a truly strategic decision. Each company, whether a small enterprise in Vancouver or a large corporation in Toronto, has unique demographics, risk profiles, budget constraints, and employee expectations. What constitutes the “best” health insurance for one organization might be entirely unsuitable for another.

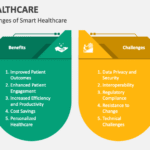

The challenges in truly comparing health insurance providers go far beyond premium costs. They encompass:

- Coverage Nuances: Discrepancies in drug coverage, paramedical services (chiropractic, physiotherapy, massage), dental plans, vision care, and mental health support. Understanding co-insurance, deductibles, and annual maximums is paramount.

- Provider Networks: Access to specialists and preferred providers, especially critical in diverse geographic areas across Canada.

- Administrative Burden: The ease of claims processing, customer service responsiveness, and online portal functionality for both HR and employees.

- Policy Flexibility & Scalability: The ability to adapt plans as the workforce evolves, accommodating new hires, family changes, or company growth.

- Long-term Cost Projections: Understanding renewal trends, factors influencing rate increases, and opportunities for cost containment.

- Legal and Regulatory Compliance: Ensuring plans adhere to provincial and federal regulations, which can be particularly complex for multi-provincial operations.

- Employee Experience: Ultimately, how easily employees can understand and utilize their benefits directly impacts their satisfaction and perceived value of the package.

Without a systematic, data-driven approach, navigating these complexities can consume countless HR hours, lead to frustration, and result in benefit packages that either overspend or underdeliver. This is precisely where intelligent automation and a well-defined AI strategy can transform the process, moving from reactive guesswork to proactive, strategic benefits management.

The AI-Powered Advantage: Transforming Health Insurance Selection

Imagine a world where your HR team doesn’t spend weeks manually sifting through dense policy documents, cross-referencing hundreds of data points, and trying to project future costs. This isn’t a distant future; it’s the present reality enabled by sophisticated AI consulting and robust business process automation. Our expertise lies in building custom solutions that leverage AI to analyze, compare, and optimize health insurance offerings with unprecedented speed and accuracy.

1. AI-Driven Policy Analysis and Data Extraction (Natural Language Processing)

One of the most tedious aspects of comparing health insurance is dissecting complex policy documents. These documents are often written in legalistic jargon, making direct comparisons difficult. This is where Artificial Intelligence, specifically Natural Language Processing (NLP), shines.

- Automated Document Ingestion: AI algorithms can ingest vast amounts of unstructured data from policy documents, benefit summaries, and provider contracts. Instead of manual review, the system quickly identifies key clauses, coverage limits, exclusions, and definitions.

- Feature Extraction & Categorization: NLP models can identify and extract crucial data points, such as drug formularies, therapy limits, deductible amounts, co-pay structures, and out-of-pocket maximums. This information is then standardized and categorized, making disparate policies comparable on an apples-to-apples basis.

- Risk Identification: AI can flag potential areas of concern, such as ambiguous language, unusual exclusions, or terms that deviate significantly from industry standards. This proactive risk identification helps prevent costly surprises down the line.

By automating this initial, laborious phase, HR teams can save hundreds of hours, ensuring greater accuracy and freeing up valuable time for strategic planning and employee engagement.

2. Machine Learning for Predictive Analytics and Cost Optimization

Beyond simple data extraction, Machine Learning (ML) algorithms can provide powerful predictive insights, moving beyond historical data to forecast future trends.

- Claims Data Analysis: ML models can analyze historical claims data (anonymized and aggregated for privacy) to identify patterns in employee healthcare utilization. This allows businesses to understand the true cost drivers for their specific workforce.

- Predictive Cost Modeling: Based on demographic data, historical claims, and market trends, AI can predict future premium increases and project the long-term financial impact of different plan designs. This empowers businesses to choose plans that are not only affordable now but sustainable in the future.

- Optimal Plan Design: ML can recommend optimal plan designs that balance cost-effectiveness with employee satisfaction. For instance, it can suggest adjusting deductibles, co-pays, or coverage limits in specific areas to achieve desired outcomes without compromising core benefits.

- Benchmarking: AI can rapidly benchmark your current or proposed plans against industry peers and similar-sized companies in your region (e.g., Canadian tech companies, manufacturing firms in Ontario), providing context on competitiveness and value.

This level of data-driven decision-making allows businesses to move beyond simple premium comparisons to a holistic understanding of value, risk, and long-term financial implications.

3. n8n Workflow Automation: The Engine for Seamless Integration and Action

While AI provides the intelligence, n8n automation provides the operational backbone, integrating various systems and automating the workflows necessary to act on AI-generated insights. N8n is a powerful open-source workflow automation tool that allows businesses to connect diverse applications and services with minimal coding.

- Data Integration Hub: N8n can act as a central hub, connecting your HRIS (Human Resources Information System), payroll software, benefits administration platforms, and even external insurance provider portals. This ensures a consistent flow of accurate data across all systems.

- Automated Comparison Workflows: Once AI has extracted and analyzed policy data, n8n can orchestrate the comparison process. It can trigger automated reports, generate side-by-side comparisons tailored to specific criteria (e.g., “best plan for employees with young families,” “most cost-effective plan for a high-turnover workforce”), and even highlight discrepancies or areas needing manual review.

- Personalized Employee Communication: When it comes to open enrollment or plan changes, n8n can automate the generation and distribution of personalized benefits summaries to employees, explaining their options based on their individual profiles (e.g., based on age, family status, location). This significantly enhances the employee experience and reduces HR inquiries.

- Compliance Monitoring & Reporting: N8n workflows can be set up to continuously monitor for changes in regulations or policy terms, automatically flagging potential compliance issues and generating necessary reports for internal review or external audits. This is crucial for navigating the complex regulatory landscape in Canada.

- Automated Onboarding & Offboarding: Streamline the process of adding new employees to benefit plans or managing benefits during offboarding, reducing manual errors and ensuring timely actions.

By implementing n8n workflows, businesses can transform their benefits administration from a manual, error-prone chore into a smooth, efficient, and highly responsive process. This is a cornerstone of digital transformation for HR departments.

Practical Takeaways and Actionable Advice for HR Professionals and Business Leaders

For HR professionals and business leaders contemplating their next health insurance review, the message is clear: the era of manual, spreadsheet-based comparisons is quickly becoming obsolete. To truly excel, you need to embrace technology.

- Define Your Criteria Beyond Cost: Before looking at any plan, clearly articulate what your company and employees truly value. Is it mental health coverage, prescription drug access, or extensive paramedical services? What are your budget limits, and what is your desired employee contribution model?

- Audit Your Current Plan: Use data to understand how your current plan is actually utilized. Where are the highest costs? Which benefits are underutilized? This internal analysis is critical for negotiating renewals and evaluating new options.

- Explore AI-Powered Solutions: Engage with AI consulting Canada firms that specialize in HR automation and benefits optimization. Understand how AI and machine learning can analyze your specific data and policy documents to provide tailored recommendations, rather than generic lists.

- Implement Workflow Automation (e.g., n8n): Look into how platforms like n8n can integrate your HR systems, automate data extraction from new policy quotes, streamline communication with employees, and ensure compliance. This reduces administrative burden and improves data accuracy.

- Prioritize Employee Experience: A benefits package is only as good as its perceived value and ease of use. Automation can personalize communication, simplify enrollment, and make claims processing seamless, leading to higher employee satisfaction.

- Focus on Long-Term Strategy: Move beyond annual renewal negotiations. Leverage AI for predictive analytics to understand the long-term implications of your choices and develop a multi-year benefits strategy that aligns with your company’s growth and financial health.

- Data Privacy and Security: When implementing AI and automation, ensure that robust data privacy and security protocols are in place, especially when handling sensitive employee health information. Partner with reputable firms that prioritize compliance.

How Our Expertise Empowers Your Health Insurance Decisions

At our core, we believe that strategic decisions, especially concerning something as vital as employee health insurance, should be powered by intelligence, not guesswork. While a “Top 10 Health Insurance Companies Compared” might offer a superficial glance, we empower Canadian businesses to conduct their own definitive, data-driven comparisons, tailored precisely to their unique needs.

Our team of AI consulting experts specializes in designing and implementing bespoke workflow automation solutions using cutting-edge technologies like n8n automation. We work closely with HR professionals and business leaders to:

- Assess Your Needs: Understand your current benefits landscape, employee demographics, organizational goals, and specific challenges.

- Develop Custom AI Models: Build AI and machine learning models tailored to your data, enabling intelligent analysis of policy documents and predictive cost modeling.

- Implement Robust n8n Workflows: Create seamless, automated workflows that integrate your existing systems, automate data processing, streamline communication, and ensure compliance.

- Provide Strategic Guidance: Offer ongoing AI strategy and digital transformation consulting to help you continuously optimize your employee benefits, reduce costs, and enhance the overall employee experience.

- Drive Data-Driven Outcomes: Equip you with the insights and tools to make highly informed decisions, leading to superior employee benefits management and significant competitive advantage.

We don’t just provide solutions; we partner with you to transform how you manage your most valuable asset: your people. In a world where talent is everything, empowering your workforce with the best benefits, efficiently managed, is no longer an option—it’s a necessity.

Ready to Optimize Your Employee Benefits with AI and Automation?

Stop settling for generic comparisons and unlock the true potential of your employee benefits strategy. Discover how AI consulting, n8n automation, and intelligent workflow automation solutions can revolutionize how you select, manage, and deliver health insurance for your Canadian workforce.

Contact us today for a personalized consultation and learn how our expertise can help you make truly data-driven decisions that benefit your employees and your bottom line. Let’s build a smarter, more efficient future for your HR and benefits management.

FAQ

Q: What is the best way to choose a health insurance provider?

A: It’s essential to define your company’s criteria beyond just cost, understand your employees’ unique needs, and use data-driven insights to guide your decision.

Q: How can AI help in comparing health insurance options?

A: AI can automate the analysis of policy documents, extract relevant data points, and provide predictive insights on costs and utilization patterns.

Q: What role does automation play in health insurance management?

A: Automation streamlines processes, reduces administrative burdens, and enhances communication with employees, making benefits management more efficient.

Q: Why should we move away from traditional methods of health insurance selection?

A: Traditional methods can be time-consuming and prone to errors. Embracing technology allows for more informed, strategic decisions that enhance employee satisfaction and reduce costs.

Q: How can I ensure compliance in our benefits program?

A: It’s crucial to continuously monitor regulatory changes and have systems in place to flag compliance issues. Workflow automation tools can help maintain compliance effectively.